I am a big fan of the Young and Invested blog. I have read his content, and find it to be very informative and accurate. This is an unsolicited plug for him, and I should be clear about that.

Recently I have been playing with my new charts based on some code that I have been writing over the last few months, a half hour here and there when I could find time. What I created was an easy way to create certain charts and tables that I could then adjust the input to consider different scenarios.

In reading Young and Invested’s post on taxes, I think I have over estimated my retirement income tax rate by a good margin. All the money I would spend would be long term investments, so the long term capitol gains rates apply. Most of our money is in traditional 401k accounts with some of the early investments in Roth 401k/IRAs. Thus, for most of this, we are talking traditional accounts. Of course a fair amount of our money is in, and will be in, standard accounts, so they too will be subject to long term capitol gains or short term as the case may be.

As my wife and I are going for a FatFIRE , the expectation is that we would still be in a relatively high tax bracket. But, since we will want to live on what we are spending now, we will be spending capitol gains and dividends. Well, I had guessed, and this was a pure guess of about 25%.

The 25% is about what we are paying now more or less. I’m not including the standard deduction and other such items as I like to over estimate my costs and under estimate my assets a little bit. This is for my piece of mind and acknowledgement of the fact that I will likely have greater expenses than I can guess.

If we assume that his chart is correct and that the first $78,000 of capitol gains income is not taxes and all gains up to $488,000 is only taxed at 15%, then a lot less of our income will be taxed. Our net tax rate will be dramatically lower.

Based on how much we want to live on I am going to make the assumption that we will have a net tax rate of about 6%. I suspect it will be less than that.

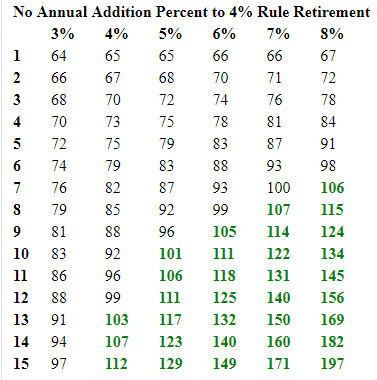

Where does the 6% come from? Well, I will deduct the $78,000 from our income which is tax free. Our actual target is a bit higher than that, but well south of $150,000. So 15% tax on that money, then averaged over the whole sum, and you get the net tax rate of about 6%. This seems logical to me. Now if I adjust my net tax rate to that, then I get the following chart of how much we need to retire.

The new tax rate dramatically lowers what we will need to live on our current income. This includes what we are paying on our mortgage, so that’s a bit of a buffer as well. The other factor is that another crash is coming. I suspect the market will be on it’s feet again when we retire, and I am hoping we will both be gainfully employed that whole time. So, this makes us is much better shape assuming my math is correct here, and my interpretation of the tax law is correct.

Just to be clear, if there is any mistake, they are all mine, and well this is just fun speculation anyway. For this one, I would be talking to a professional when we get close to this number.

This scenario makes retirement in 10 years a real reality and the possibility of retiring even sooner possible. I am not sure I would be at peace retiring with this number, but since I plan on retiring to a less stress job that hopefully pays well, then this would not be the end of the world.

Now to be consistent, even if we don’t add money to our retirement, then we still have a chance to retire in 10 years with the padding of the extra spending for the mortgage which will be paid off in 10 years or so regardless.

Overall, this is good news. I am curious for some feedback on these numbers. Does anyone think this is wrong?

I believe the withdrawal amounts from your retirement accounts (401k, IRA) are taxed at ordinary rate. You do not get long term capital gain treatment for them.

LikeLike

Thank you for the correction. I need to update my model. Coincidentally, I read that over the weekend from a better source. I will update this post and my model accordingly.

I need to account for both my Roth and Traditional accounts. We have both R and T 401ks and IRAs.

LikeLike